Invoice Guru

Invoice Guru is HMRC-compliant invoicing software that boosts productivity for UK tradespeople.

Visit

About Invoice Guru

Invoice Guru is an enterprise-grade, mobile-first invoicing and compliance platform engineered specifically for tradespeople, freelancers, and small service businesses operating on-site. Unlike traditional desktop accounting software, Invoice Guru is built from the ground up to address the unique challenges of mobile, field-based work, enabling professionals like plumbers, electricians, builders, and cleaners to manage their financial operations with unprecedented speed and efficiency. The core value proposition centers on eliminating administrative overhead, accelerating cash flow, and ensuring seamless regulatory compliance. By leveraging real-world automation, AI-driven tools, and deep bank integrations, the platform transforms invoicing from a time-consuming chore into a strategic, revenue-generating activity. It is designed with future-proof compliance at its core, proactively adapting to regulations such as the UK's Making Tax Digital (MTD) and Poland's KSeF, thereby protecting businesses from costly software migrations and compliance penalties. Founded by a tradesperson with firsthand operational experience, Invoice Guru delivers a tangible ROI by reducing invoice creation time to under 60 seconds, automating payment reconciliation, and providing actionable financial insights—all from a user's smartphone.

Features of Invoice Guru

Instant HMRC-Compliant Invoice Creation

Create and dispatch a fully branded, professional invoice in less than 60 seconds directly from your mobile device. The platform automates the inclusion of your logo, VAT details, payment terms, and due dates, utilizing HMRC-compliant templates. This eliminates reliance on error-prone manual templates in Word or Excel, ensuring every document meets UK regulatory standards from the moment of creation, thereby accelerating client billing and improving cash flow velocity.

AI-Powered OCR Receipt Scanner

Streamline expense management by simply photographing a receipt. Invoice Guru's advanced AI engine automatically extracts and populates key details including supplier, date, total amount, and VAT. This data is instantly logged as a categorized expense, eliminating hours of manual data entry per month. This feature provides a clear, auditable trail of business costs, simplifying reporting and maximizing deductible expense claims with minimal effort.

Automated Bank Integration & Payment Matching

Securely connect your business bank account to enable real-time financial synchronization. The system automatically matches incoming bank transactions with outstanding invoices in your ledger. This automation provides an instant, accurate view of cash flow, showing precisely which clients have paid and which invoices are overdue, effectively eliminating manual reconciliation and reducing the risk of human error in financial reporting.

Proactive Compliance & Multi-Region Support

Invoice Guru is engineered as a future-proof compliance hub, pre-configured for evolving regulations like UK MTD and Poland's KSeF. This ensures your business remains compliant without disruptive software changes. Furthermore, it supports international operations with multi-currency invoicing (£, €, zł, Ft) and 12 languages, allowing you to seamlessly service clients across Europe while maintaining local fiscal formatting standards.

Use Cases of Invoice Guru

For Independent Tradespeople & Sole Traders

Sole operators such as electricians or painters can leverage Invoice Guru to manage their entire invoicing lifecycle from job site to bank account. They can create an invoice immediately upon job completion, send it via email with one tap, and track its status—all from their phone. Automated reminders for overdue payments and simple expense tracking via receipt scanning turn administrative hours back into billable hours, directly boosting profitability.

For Small Service Business Teams

Growing small businesses with a small crew, like a local plumbing or cleaning company, use Invoice Guru to standardize and accelerate their billing processes. The centralized platform ensures every team member generates consistent, professionally branded invoices. Features like automatic invoice numbering and deposit tracking provide clear financial oversight for the owner, while bank integration offers a real-time view of company-wide cash flow.

For Freelancers Managing International Clients

Freelancers and consultants who work with clients across different European countries utilize the multi-currency and multi-language capabilities. They can issue invoices in the client's local currency and language, reducing friction and speeding up payment. The automated compliance features ensure invoices meet local requirements, allowing the freelancer to focus on service delivery rather than navigating complex international tax rules.

For Businesses Preparing for MTD Compliance

UK-based trades and small businesses proactively adopt Invoice Guru to ensure a smooth, uninterrupted transition to HMRC's Making Tax Digital requirements. By using an MTD-ready platform from the outset, they avoid the cost, training, and data migration challenges associated with switching software later, securing their compliance posture well ahead of regulatory deadlines.

Frequently Asked Questions

Is Invoice Guru compliant with HMRC's Making Tax Digital (MTD) rules?

Yes, Invoice Guru is designed as HMRC-approved MTD-compliant software. It generates invoices using compliant templates and is built to seamlessly integrate with and submit data to HMRC's MTD system. This ensures your business meets current and upcoming digital tax filing obligations without requiring a change of platform, future-proofing your compliance strategy.

How does the automated bank integration and payment matching work?

You securely connect your business bank account via open banking protocols. Invoice Guru then imports your transactions automatically. Its intelligent engine matches the amount and reference data of incoming payments against your list of sent invoices. This automatically updates invoice statuses to 'Paid,' providing a real-time, accurate view of your accounts receivable and eliminating all manual payment reconciliation work.

Can I use Invoice Guru for clients outside the UK?

Absolutely. Invoice Guru supports multi-currency invoicing (including GBP, EUR, PLN, HUF) and offers interfaces in 12 languages. This allows you to create professional invoices tailored to international clients, handling different date formats and fiscal presentation standards, making it ideal for tradespeople and small businesses operating or servicing clients across Europe.

What happens during the free trial period?

The free trial offers full, unrestricted access to all core features of Invoice Guru, including instant invoice creation, OCR receipt scanning, and bank integration. No credit card is required to start. This allows you to thoroughly test the platform's efficiency in your real-world workflow, process actual invoices, and measure the time savings before making any financial commitment.

Pricing of Invoice Guru

Invoice Guru is currently offering an exclusive Early Access program. Interested professionals, particularly those in the UK, can join a limited number of spots to test the platform. As part of this program, participants receive 1 month of service for free in exchange for their valuable feedback. This initiative requires no credit card to sign up, providing a risk-free opportunity to evaluate the software's impact on business productivity and compliance management before general release and standard pricing tiers are announced.

You may also like:

Moon Banking

The largest global bank dataset with AI-native integrations (MCP, OpenClaw, API). For analysts, marketers, developers, institutions.

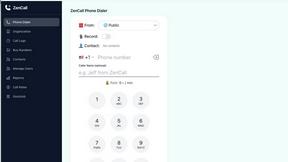

ZenCall

Browser-based international calling with transparent pay-as-you-go pricing. No apps, no subscriptions—just affordable global calls.

ExpenseManager

All-in-one app to track expenses, split bills, scan receipts, and forecast cash flow — for individuals, couples, and groups.