Pennyflo

About Pennyflo

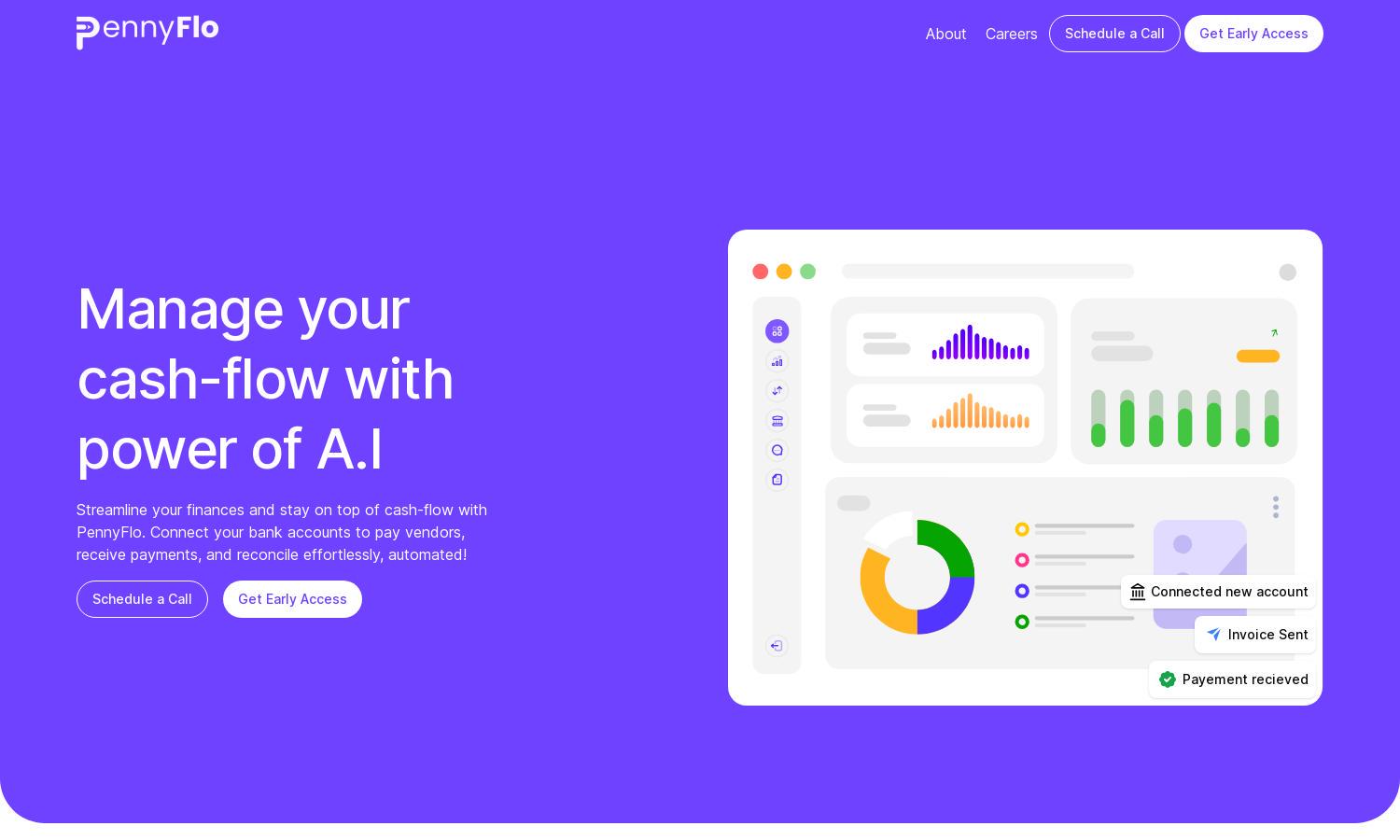

Pennyflo is an innovative cash management platform designed to assist businesses in optimizing their financial operations. It features an AI-powered co-pilot that consolidates cash flow insights in real time, enabling finance teams to automate tasks, enhance collaboration, and make data-driven decisions effortlessly.

Pennyflo offers flexible pricing plans tailored for various business needs, ensuring accessibility for all users. Whether opting for basic or premium tiers, you'll enjoy unique features like real-time cash flow tracking and automated reconciliations. Upgrading unlocks advanced analytics for smarter financial management.

Pennyflo's user interface is expertly designed for seamless navigation, featuring a clean layout that enhances the browsing experience. Users can easily access essential tools like cash reports, banking automation, and dynamic forecasts, making it a user-friendly platform to manage finances efficiently.

How Pennyflo works

Users start with a straightforward onboarding process on Pennyflo, where they connect their financial tools and input relevant data. Once set up, they can seamlessly navigate the dashboard to access real-time cash flow insights, customize reports, and automate banking tasks. The intuitive design prioritizes user experience, ensuring that teams can collaborate effectively while utilizing advanced AI analytics to mitigate cash risks.

Key Features for Pennyflo

AI-powered co-pilot

Pennyflo features an AI-powered co-pilot that revolutionizes cash flow management. This unique feature assists finance teams by providing real-time insights, automating routine tasks, and facilitating strategic decision-making. Enhancing operational efficiency, it stands out as a pivotal tool for businesses aiming to optimize their cash flow.

Dynamic Forecasts

The Dynamic Forecasts feature of Pennyflo empowers users to leverage their financial data to plan for future scenarios. By analyzing trends and making projections, businesses can navigate uncertainties confidently. This capability ensures informed decision-making, ensuring financial stability and growth in an ever-changing market.

Automated Banking & Reconciliations

Pennyflo’s Automated Banking & Reconciliations enhances efficiency by synchronizing real-time banking data with cash flow reports. This feature simplifies reconciliations, reduces manual errors, and saves time, enabling finance teams to focus on strategic planning and improving overall financial health.

You may also like: