finbots.ai

About finbots.ai

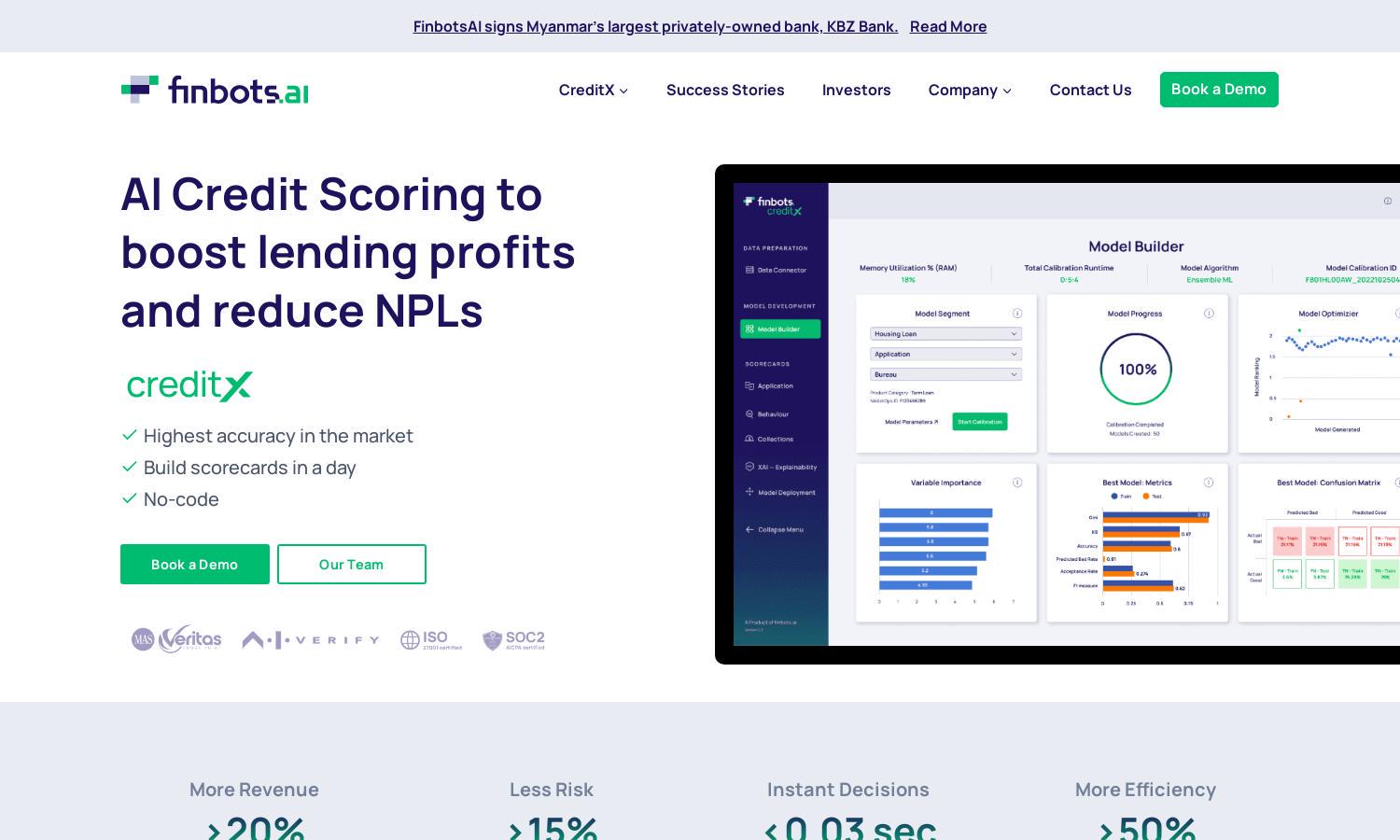

Finbots.ai is a leading AI credit risk platform that provides innovative solutions for lenders. Its core functionality includes rapid, customizable credit scorecards that help businesses make smarter lending decisions. By streamlining credit risk management processes, Finbots.ai enhances efficiency and accuracy, making it invaluable for the finance industry.

Finbots.ai offers competitive pricing with flexible plans, making it affordable for diverse lending organizations. New users can benefit from a 30% discount for the first six months. Upgrading provides access to advanced features, ensuring enhanced decision-making and overall profitability for financial services.

Finbots.ai has an intuitive user interface designed for seamless navigation and interaction. Its layout prioritizes user experience, incorporating easy access to features such as scorecard building and monitoring. This user-friendly design enables clients to efficiently harness the platform's capabilities, ultimately streamlining their lending processes.

How finbots.ai works

Users begin their interaction with Finbots.ai by signing up and onboarding. The platform allows lenders to connect internal, external, and alternate data easily. Following this, users can build custom scorecards in just one day using powerful AI algorithms. Deployment is simple, enabling instant decision-making, and clients can continuously monitor their models' performance through insightful reports.

Key Features for finbots.ai

Custom Scorecards

Finbots.ai's custom scorecards allow lenders to create tailored credit evaluations quickly. This feature simplifies the scoring process, enhancing accuracy and efficiency while reducing the time to deploy solutions. With proprietary AI, Finbots.ai empowers users to make informed lending decisions that drive profitability.

Real-Time Decisioning

Finbots.ai offers real-time decisioning capabilities that streamline the lending process for clients. By ensuring accurate and prompt credit assessments, this feature maximizes efficiency and enhances customer satisfaction, allowing lenders to offer competitive solutions in today’s fast-paced financial landscape.

Data Integration

Finbots.ai excels in data integration, allowing lenders to seamlessly connect various data sources. This feature ensures comprehensive access to vital information, empowering users to make well-rounded credit decisions while enhancing the accuracy of their risk assessments in a rapidly evolving lending environment.

You may also like: